- Services

- Airports

- Alcohol Licensing

- Animal Control

- Building Services

- CCTV - Public Use

- Cemeteries

- Environment and Sustainability

- Environmental Health

- Permits

- Rates & Property

- Resource Consents

- Rubbish & Recycling

- Services A - Z

- Summer Services

- Transport and Parking

- Water Services

Development contributions

Utu whakawhanake

A development contribution is a financial charge levied on new developments to ensure that any party who creates additional demand on local infrastructure contributes to the extra cost they impose on the community. It is assessed and collected under the LGA 2002.

Quick links

Latest Development Contribution Policy

The Local Government Act 2002 allows Council to update the policy annually (ahead of the LTP process) to account for annual inflation, in line with the Producers Price Index (PPI) outputs for construction. The annual change between September 2023 and September 2024 was 2.4%. This has been used as a proxy for one year’s inflation as it is the latest data available at the time this work was prepared.

Click on the link below for the changes to Development Contributions for 2025-2026, following the annual policy update.

Past Development Contribution Policy

2021-2031 Long Term Plan

What do they relate to?

Development contributions relate to the provision of the following council services:

-

Water supply.

-

Wastewater supply.

-

Stormwater supply.

-

Reserves, Reserve Improvements and Community Facilities.

-

Transportation (also known as Roading).

When is a development contribution triggered?

A Development Contribution is triggered by:

-

the granting of a Resource Consent,

-

the issue of a Building Consent, or

-

the receipt of an application for a Utility Service Connection.

What costs are involved?

All estimates undertaken by a Development Contribution Officer will be subject to fees. The extent of cost will be relative to the complexity and time taken to perform the assessment.

When do development contributions need to be paid?

-

Payment is due upon the granting of a land use consent. Where a Building consent is also required payment is due prior to the issue of the code of compliance certificate or prior to the connection to Council services, whichever comes first.

-

Payment is due prior to the issue of the section 224c certificate or prior to the connection to Council services, whichever comes first.

-

Payment is due prior to the issue of the Code Compliance Certificate or prior to the connection to Council services, whichever comes first.

-

Payment is due prior to the issue of the Utility service connection approval.

How are development contributions assessed?

The following existing demand and credit considerations apply to all assessments:

-

The existing demand of any lot that is to be developed will be converted to a dwelling equivalent credit when assessing development contributions. Thus, development contributions are solely for additional demand created by the new development.

-

Credits will be specific to the activity for which they were paid (i.e. a water supply credit will not be able to offset a wastewater contribution).

-

Credits are to be site specific (not transferable) and non-refundable unless the refund provisions of the Act apply.

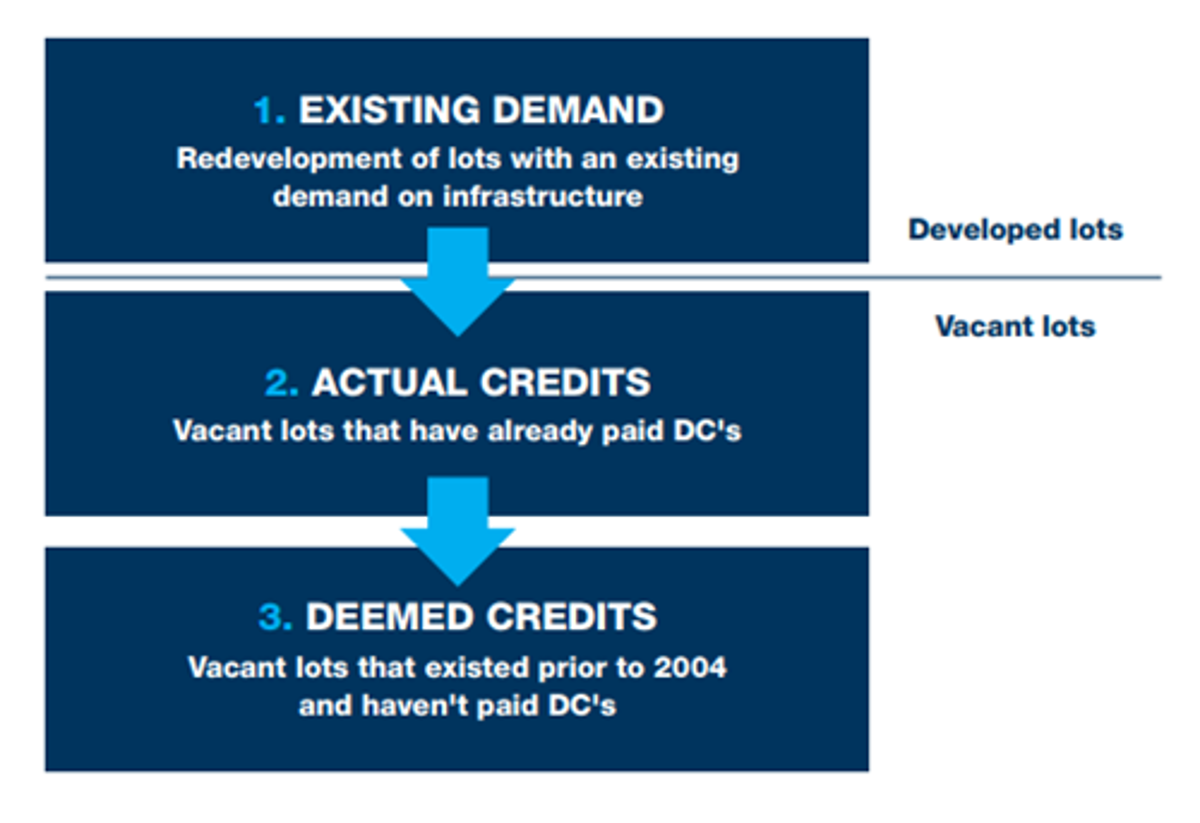

There are three types of development contribution credits that may be applied:

Can development contributions be reconsidered?

You can request for your development contribution requirement to be reconsidered if you have grounds to believe that:

-

the development contribution was incorrectly calculated or assessed under our Development contributions policy; or

-

Council incorrectly applied its Development contributions policy; or

-

the information used to assess the person’s development against the Development contributions policy, or the way Council has recorded or used it when requiring a development contribution, was incomplete or contained errors.

A request for reconsideration must be made in writing stating clearly on which grounds the applicant believes the Council has erred. The request for reconsideration must be made within 10 working days after the date on which the person lodging the request receives notice from Council of the level of development contribution that Council requires. To do this, please complete the request for reconsideration online form and include relevant documents.

The steps that Council will apply when reconsidering the requirement to make a development contribution are:

-

The appropriate Council officer shall review the reconsideration request.

-

The Council officer may request further relevant information from the applicant.

-

The Council officer will make a recommendation to the delegated authority.

-

Council will, within 15 working days after the date on which it receives all required relevant information relating to a request, give written notice of the outcome of its reconsideration to the person who made the request.

A reconsideration cannot be requested if the applicant has already lodged an objection. If the applicant is not satisfied with the outcome of the reconsideration, they may lodge an objection as specified in the Local Government Act 2002 Amendment Act (No 3) 2014, s199C to s199N.